When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the dividends payable account, thereby reducing equity and increasing liabilities. Thus, there is an immediate decline in the equity section of the balance sheet as soon as the board of directors declares a dividend, even though no cash has yet been paid out. Sometimes companies choose to pay dividends in the form of additional common stock to investors. This helps them when they need to conserve cash, and these stock dividends have no effect on the company’s assets or liabilities. The common stock dividend simply makes an entry to move the firm’s equity from its retained earnings to paid-in capital.

- Accounting practices are not uniform concerning the actual sequence of entries made to record stock dividends.

- The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000.

- The amount at which retained earnings is debited depends on the level of stock dividend, i.e. whether is a small stock dividend or a large stock dividend.

- The treatment as a current liability is because these items represent a board-approved future outflow of cash, i.e. a future payment to shareholders.

Get in Touch With a Financial Advisor

Therefore the cost per share to the investor is reduced to $50 per share ($60,000 + 1,200 shares), from the original $60 per share. Thus, no income is recognized on the stock dividends when they are received. Subsequently, South Gulf issues a 20% stock dividend, and so the investor will receive an additional 200 shares (1,000 x .20). A stock dividend is a distribution of shares of a company’s stock to its shareholders. The number of shares distributed is usually proportional to the number of shares that each shareholder already owns. Under current accounting practices, non-cash dividends are revalued to their current market value and a gain or loss is recognized on the disposition of the asset.

Capitalization of Retained Earnings to Paid-Up Capital

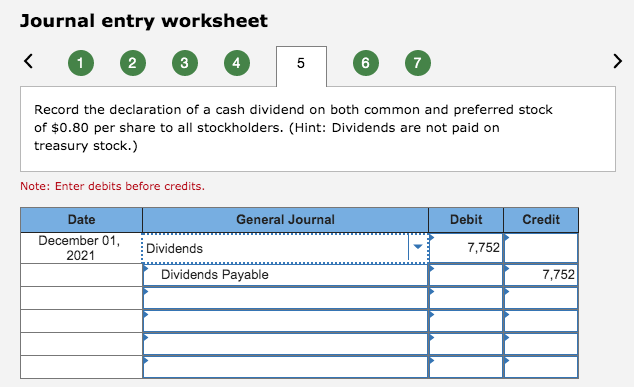

The related journal entry is a fulfillment of the obligation established on the declaration date; it reduces the Cash Dividends Payable account (with a debit) and the Cash account (with a credit). The board of directors of a corporation possesses sole power to declare dividends. The legality of a dividend generally depends on the amount of retained earnings available for dividends—not on the net income of any one period. Firms can pay dividends in periods in which they incurred losses, provided retained earnings and the cash position justify the dividend. And in some states, companies can declare dividends from current earnings despite an accumulated deficit.

Example of the Accounting for Cash Dividends

Receiving the dividend from the company is one of the ways that shareholders can earn a return on their investment. In this case, the company may pay dividends quarterly, semiannually, annually, or at other times (either fixed or not fixed). To record the payment of a dividend, you would need to debit the Dividends Payable account and credit the Cash account. When the dividend is paid, the company’s obligation is extinguished, and the Cash account is decreased by the amount of the dividend. To see the effects on the balance sheet, it is helpful to compare the stockholders’ equity section of the balance sheet before and after the small stock dividend.

Share This Book

After all these entries have been made, total stockholders’ equity remains the same, because there has not been a distribution of cash or other assets. Record the declaration and payment of the stock dividend using journal entries. It is useful to note that the record date is the date the company determines the ownership of the shares for the dividend payment. Like in the example above, there is no journal entry required on the record date at all. For example, on December 14, 2020, the company ABC declares a cash dividend of $0.5 per share to its shareholders with the record date of December 31, 2020.

On the payment date, the following journal will be entered to record the payment to shareholders. In contrast, an established business might not need to retain profits and will distribute them as a dividend each year. The investors in such businesses are looking for a steady growth in the dividends. Deciding when to start paying dividends, how much to pay, and how frequently to pay them can be difficult. These can be key signals in the maturity of your business and optimism of the business owners or directors. And not all businesses are strong enough to issue dividends year-in and year-out.

When investors receive a stock dividend, the cost per share of their original shares is reduced accordingly. It is a temporary account that will be closed to the retained earnings at the end of the year. The final entry required to record issuing a cash dividend is to document the entry on the date the company pays out the cash dividend. The first step in recording the issuance of your dividends is dependent on the date of declaration, i.e., when your company’s Board of Directors officially authorizes the payment of the dividends. To illustrate, assume that Ironside Corporation declared a property dividend on 1 December to be distributed on 4 January.

Some companies issue shares of stock as a dividend rather than cash or property. This often occurs when the company has insufficient cash but wants to keep its investors happy. When a company issues a stock dividend, it distributes additional shares of stock to existing shareholders. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits.

This records the reduction of the dividends payable account, and the matching reduction in the cash account. When a dividend is later paid to shareholders, debit the Dividends Payable account and credit the Cash account, thereby reducing both cash and the offsetting liability. On the initial date when a dividend to shareholders is formally declared, the company’s retained earnings account is debited for the dividend amount while the dividends payable account is credited by the same amount. On the payment date of dividends, the company needs to make the journal entry by debiting dividends payable account and crediting cash account.

The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit). The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase brooklyn ny accounting and tax preparation firm (credit) to Property Dividends Payable for the $210,000. The most important thing to note by comparing the stockholders’ equity section in both balance sheets is that the total is $3 million In both cases. The only difference is the total of the various accounts within stockholders’ equity.

Assuming there is no preferred stock issued, a business does not have to pay dividends, there is no liability until there are dividends declared. As soon as the dividend has been declared, the liability needs to be recorded in the books of account as dividends payable. Since the cash dividends were distributed, the corporation must debit the dividends payable account by $50,000, with the corresponding entry consisting of the $50,000 credit to the cash account.

Leave a reply